1980Mooney

Verified Member-

Posts

3,660 -

Joined

-

Last visited

-

Days Won

7

Content Type

Profiles

Forums

Blogs

Gallery

Downloads

Events

Store

Everything posted by 1980Mooney

-

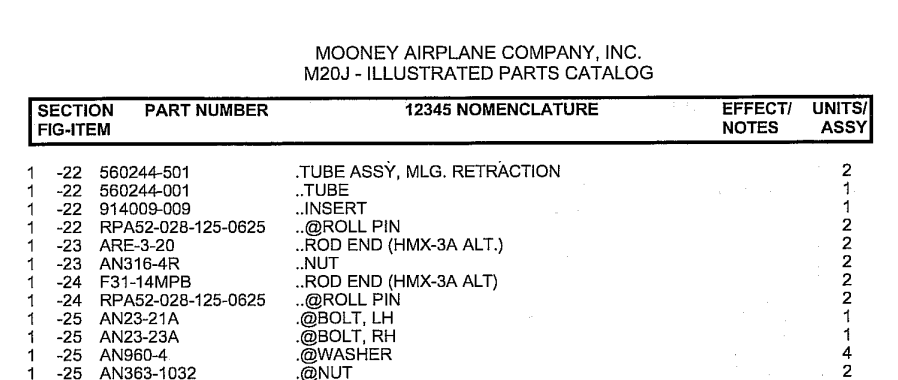

I am confused by the part numbers mentioned here and on page three. I think the control rods that are bent are 550244-501 That is the entire rod with rod ends on each end (including parts ARE-3-20 and F31-14MPB) As Skip said there are "2" complete rods for the MLG If you just want the tube without the rod ends it is part 560244-001 There is "1" tube within each complete entire rod `The salvage yards get them confused and use then interchangeably. Here is a BAS ad for the part number that is just the rod (out of stock -sorry) but you can see that it has the rod ends. They call it 560244-001 https://baspartsales.com/560244-001-mooney-m20k-landing-gear-retract-rod-assembly/

-

Remember that he has an early J with the Dukes actuator. I have no experience with it and don’t know if it differs from the Eaton.

-

Note in the "Bent Push Pull Rods" Dec 15 2022 topic, that he used straight edges to check the rods without disassembly. When you buy a Mooney, there can always be delays in parts. Luckily there is a lot of scrap parts. The factory does make parts....slowly. And as @KSMooniac said a good A&P can repair a lot of parts. I have owned a Mooney through bankruptcies and shutdowns. The biggest delay I ever had was waiting on Rocket Engineering to repair my engine mount frame (unique to the Missile conversion). Nowdays engine overhauls are taking longer than waiting for parts from Mooney.

-

Here is another video showing the micro (stop) switches in action. It has an Eaton actuator but the principle is the same.

-

A clean “oh crap I completely forgot “ gear up generally does not tear up the rods, turnbuckles or actuator. It is the remembering and dropping the gear(partially extended)just as you touchdown, the porpoising nose gear collapse, the side skid collapse, and the improper gear rigging/weld crack collapse that tears up and bends everything in the landing gear system.

-

once you get it up on jacks here is a video for reference

-

Only one of the 2 MLG tubes is bent? Everything is linked together. If it bent (buckled) because the Dukes actuator over- extended (due to lack of microswitch stop) then everything was overextended. Every tube should be checked for straightness. And turnbuckles for any On the other hand perhaps the one tube had some residual damage from the original gear up and it was the first to bend. check out this post

-

Also I have always found KNR- Inc., a Mooney specific shop out of Evanston, WY, to be a great online resource. They have a "Shop Talk" section that is very knowledgeable and pragmatic. Everyone has their favorite - my 2 cents. ShopTalk Index (knr-inc.com) Regarding Mooney specific pre-buy 200404 Caveat Emptor, Caveat Vendor (pre-buy) (knr-inc.com) 201712 Pre-buy Part 1 (knr-inc.com) 201801 Pre-buy Part 2 (knr-inc.com)

-

Look - I agree with your point. Anyone buying a plane should look at the Serial Number to avoid confusion. Advertisements and owner statements can be misleading. Also if you search a plane by Serial Number you may find that the N-Number changed along the way.

-

Also you may have already seen some of theses From one of our MS'ers @201er Also Emergency Gear Swing by @201er

-

Uh - Eric above raised doubt "If somebody says they have a 76 J model, I wonder whether they really mean an early J or an actual 76F that has essentially been converted." THERE IS NO DOUBT.

-

Since you have narrowed your interest to a M20J POH Service Manual Wiring Diagrams (safe to open) mooney.free.fr/Manuels M20J/M20J/Mooney Service Manuel M20J Vol. 2 of 2.pdf Parts

-

Come on guys - this discussion is getting goofy. The Serial Number says it all. As posted on page one N201JK is Serial Number 24-0040. You can look it up on Aircraft Inquiry (faa.gov) It is a M20J. Period. Go look at the parts manual and the service manual (both are posted on MS). Parts and service is identified by Serial Number - not "year of Mooney" or date of Certification.

-

Lots of confusion here. Suggesting mechanical stripping. Or painting /feather the new polysulfied sealant over-the urethane . Or put in bladders

-

This says proprietary polyurethane.

-

Removal of Hydraulic pump with O-ring replacement

1980Mooney replied to Saira's topic in General Mooney Talk

Not videos but might help..... -

Another tidbit. I am the same height as you. Based upon your past GA experience, you will probably find the Mooney panel height to be taller than the ones you previously flew. The height adjustable/articulating seats w/ armrest were an option on some planes - they are nice but heavier eating up UL Some people have salvaged and added them - price is ridiculous - Alan Fox has a used pair that need repair for sale now - Price $6,100 plus shipping. Mooney articulating front seats | eBay I simply use a quality travel seat cushion (memory foam) - works perfectly - boosts me up a little and is comfortable. Also you will see some comments about extensions on the toe brake pedals. - there are 1.5 inch and 3 inch extension I have never needed extensions - stock seems fine to me

-

No back spring in landing gear actuators

1980Mooney replied to M20S Driver's topic in Modern Mooney Discussion

You really think people would buy an unproven spring? One that, if it breaks while retracting the gear, the gear will not go down for landing. That will insure a gear-up landing and in this market, down for a year, that is if the insurance company doesn't scrap the plane. If I was looking to buy a plane that the Logs showed had an OPP or "Off Brand X" no-back spring, the deal would have to be contingent on the Seller replacing the spring at their expense. Just my 2 cents. -

Other than the modern fiberglass interior, starting with Ser. no. 24-3374, which replaced the cheap flimsy, (brittle over time), "Royalite" ABS interior panels and foam sound deadening material replacing cheap fluff fiber glass insulation, can you explain how they got heavier? Yes some later ones came with the highly sought after fully adjustable (and heavier) pilot seats with arm rests. But same engine, same steel frame, same skins, same tires. We have all replaced the fluff insulation with more substantial sound deadening foam. Later models came from the factory with more (heavier) avionics, and yes there are some out there for sale with practically original panels, but as owners upgrade avionics over time all the planes become lighter and more similar. A 160 lb. GW improvement is a real improvement. That said, it is basically a "paper" improvement. All Mooney's built in the last 60 years fly on and are lifted by the same wing (same airfoil, same area, same lift). They are all are suspended on the ground with the same exact shock discs in the landing gear. Yet GW went from 2,450 lbs to 3,380 lbs. The only fundamental difference is the power used to propel the plane. I have pointed out previously that Rocket Engineering, got the FAA to certify that the earlier J's with the 2 thinner steel tubes, could be certified to 3,200 lbs. GW in the Missile conversion, without any structural modification. On trips I fly at 3,200 lbs in the same airframe that I was previously limited to 2,740 lbs. No Missile has ever had a structural issue.

-

The later J models had a small modification that allowed the GW to increase to 2,900 lbs from 2,740 lbs. All Serial Numbers 24-1686 and above had 2 tubes in the side of the steel cage with a slightly greater wall thickness (.049 vs .035) M20J Serial Number 24-3057 and above are certified at 2,900 lbs. GW M20J Serial Number 24-1686 through 24-3056 can be certified via STC (basically 1988 and newer) https://mooneyspace.com/applications/core/interface/file/attachment.php?id=95270 It basically involves relabeling the ASI, checking the balance of your rudder and POH additions. For your mission look for 1988 or newer. Many will already have the GW increase STC.

-

Here is a Youtube of the folding backseats in a Mid-Body M20K (same interior dimensions as a J). I do not think there is any way to put a bicycle in a Mooney unless it is a folding frame. For that you need an A36 or a big Piper 6 - Saratoga or Dakota

-

The airworthiness date on his plane (serial number 24-0040) is 11/18/1976. But yes it is technically a "1977 Model" https://www.mooneyevents.com/chrono.htm

-

Welcome onto the forum. A lot of your mission fits a M20J. But then there are a few issues. Years ago, when we we were a lightweight family like yours also based in the Houston area, we had a similar mission and bought our M20J. Trips to Central TX hill country, South TX South Padre, Florida panhandle, Destin, all with seats filled worked well We also frequently took trips to New Mexico with seats filled - the plane was adequate but density altitude planning always critical, especially in the summer. I elected to have the Rocket Engineering "Missile" STC which added an IO-550. This gave it Ovation like performance which better handles flying in New Mexico and Colorado. Just about any Mooney with the right avionics is a "strong IFR platform". Ours does not have split/removable rear seats - that was a feature starting in 1982 Skip posted this link https://mooneyspace.com/applications/core/interface/file/attachment.php?id=128630&key=679a9d65c36d11a698921a4cea2a60b3 You mention "2 pax plus rifles" - that sounds like you might benefit from the greater backseat and luggage space (length) in a Long Body. You could take one seat out and lay the guns down. You said "don't intend to fly regularly in widespread low imc or night imc" I am not sure if you meant you need to be able to handle all kinds of weather conditions "occasionally". If you need FIKI and need to get over some weather in the lower Flight Levels, then that changes things - it narrows your options. You would need a Bravo M20M or Acclaim M20TN. I think there are a few Encore M20K with FIKI but they are scarce and weak on UL And last, since you are based in Houston you didn't mention Air Conditioning. Perhaps your past GA experiences were here and you have already factored long IFR releases in during hot humid nearly unbearable weather. I manage without A/C by loading/fuel/preflight and keeping it out of the sun in the hangar before family arrives. Just my experience.

-

It is an interesting idea. However the Powerflow is installed per STC. And the website says "disassembly, cleaning and lubrication are required Annually". The moly lube only addresses one aspect of the STC Annual requirement. I have not seen the actual STC instructions, but I bet you are still stuck with the extra labor every year.