1980Mooney

Basic Member-

Posts

3,228 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Blogs

Gallery

Downloads

Media Demo

Events

Everything posted by 1980Mooney

-

Can you elaborate?

-

What can cause a magnetized cage in the Ovation?

1980Mooney replied to Ed de C.'s topic in Modern Mooney Discussion

Are you talking about this? https://mooney.com/wp-content/uploads/2020/12/SBM20-150A.pdf -

What can cause a magnetized cage in the Ovation?

1980Mooney replied to Ed de C.'s topic in Modern Mooney Discussion

Been discussed before. Everyone in old topic below says an AC cord cannot magnetize anything because it keeps alternating and reversing fields. DC power cords will magnetize the steel frame. Your 28v wires either zip tied across or along the tubing are more likely to cause magnetism. In 25 years of the same plane, I have had corded vacuums, lights, power tools in the cabin - sometimes for long periods like while replacing cabin insulation. One especially humid Gulf Coast winter in a crap hanger without sealed concrete I had a low wattage incandescent light with a small fan running continuously in the cabin for a while. Never a problem. As @Hank says, a canister on the wing with a hose may work better given the limited space. Also the motor heat blowing into the cabin is unbearable most times. I generally also just set on the wing. -

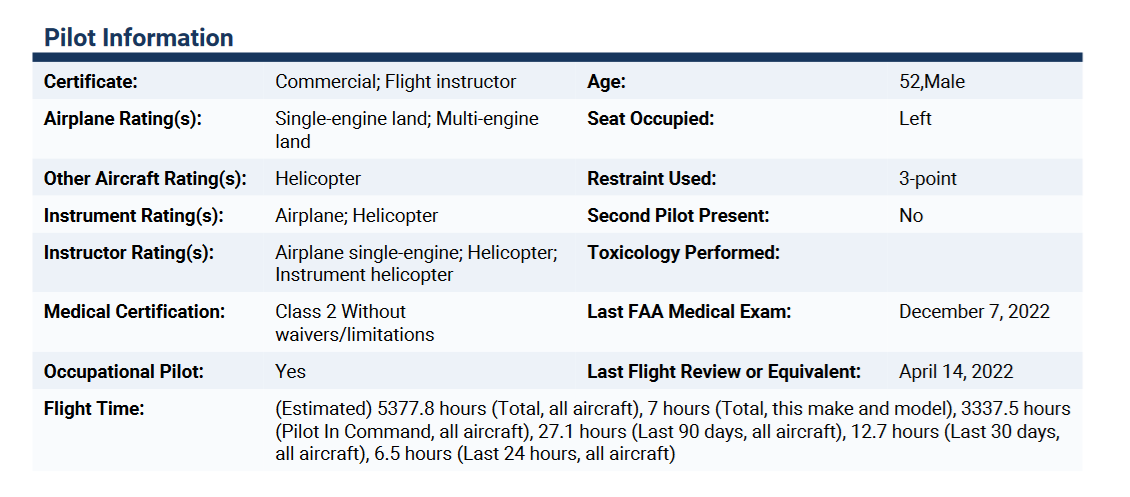

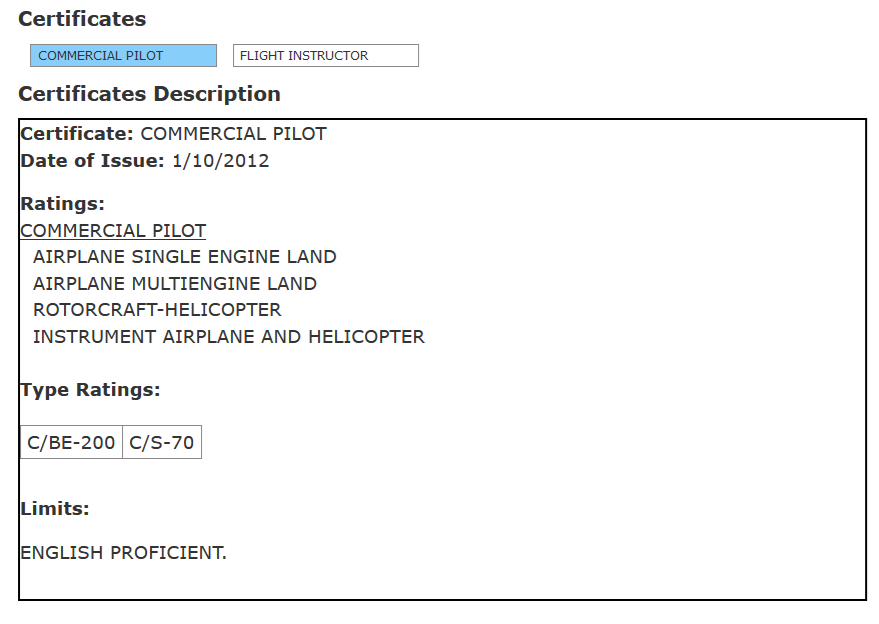

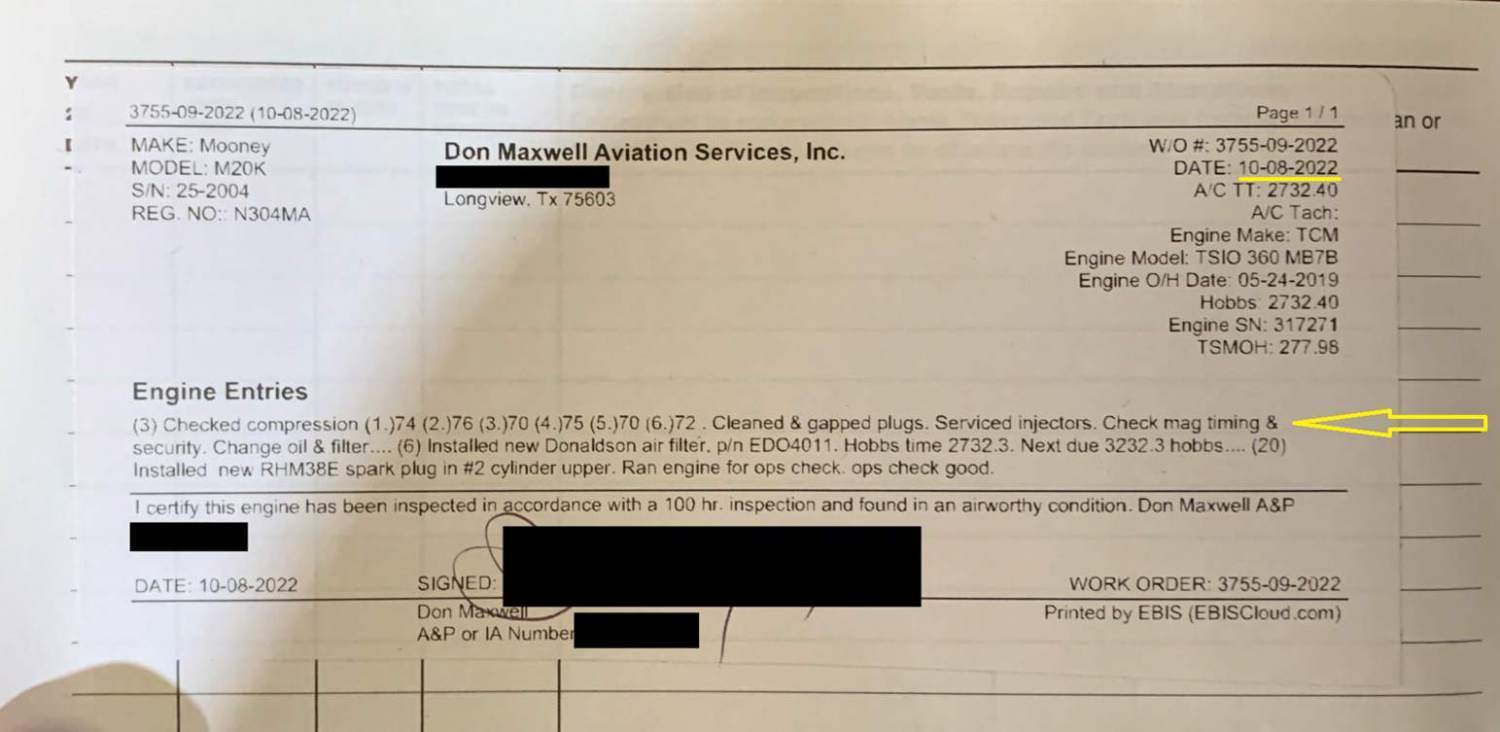

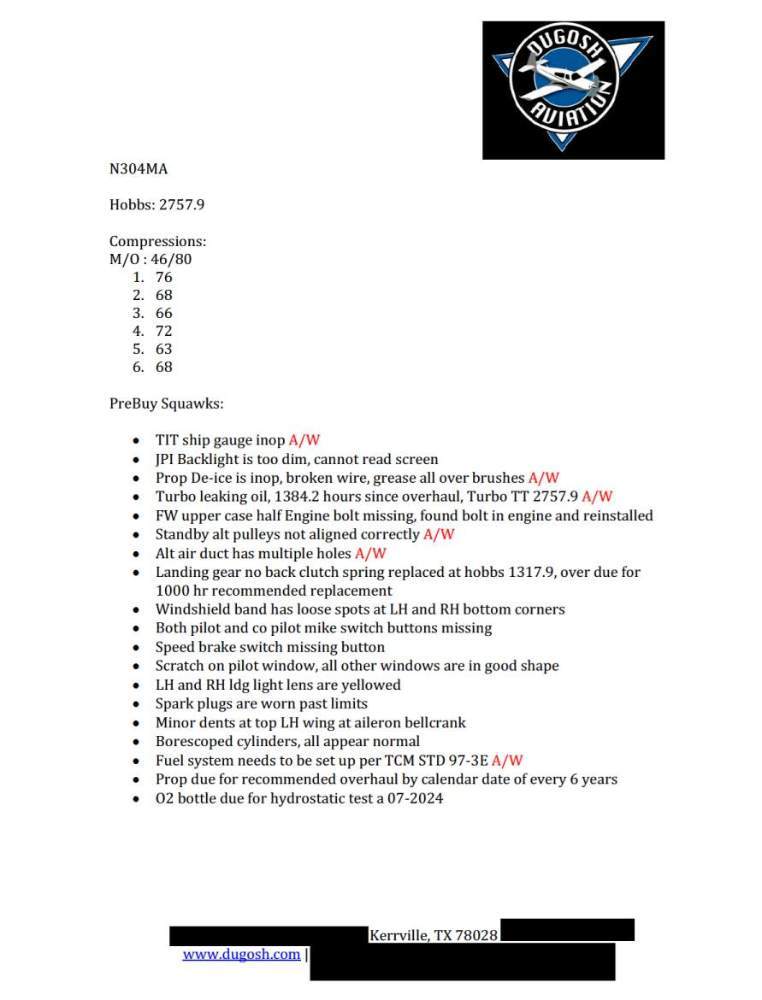

All interesting. The Aircraft, Engine and Prop Logs are in the Docket from 2018 on to the time of the accident. This Encore was owned by PA Aviation LLC in Burleson, TX from 2012 to just before the accident on February 12, 2023 The plane was in Kerrville (presumably Dugosh) from January 16-23, 2023 and then returned to Kestrel The new owner (Commercial & Helo Pilot/CFI owner and PIC during crash) appears to be flying transition training on February 11, 2023 - the day before the accident The plane flew from Kestrel in 6 legs eventually back to Kestrel - total duration 6.5 hours ADS-B Exchange - track aircraft live (adsbexchange.com) While owned by PA Aviation LLC, the owner seemed to have mostly the "best of the best" work on the plane All Annuals were done by Maxwell during the entire period (before and after the Overhaul) In July 2019 Maxwell performed the Overhaul with the engine done by Jewel In August 2019 LASAR in California worked on the plane - entry says " tightened most of the induction clamps. Set MP to 39" @ Full Power" "replaced TIT probe and OPS check normal on JPI" In September 2019, for some reason, Maxwell worked on the TIT probe again In February 2021, Maxwell installed Garmin G5's and GFC500 autopilot and removed the vacuum system. https://data.ntsb.gov/Docket/Document/docBLOB?ID=17141507&FileExtension=pdf&FileName=Engine Maintenance Records - 2018 to Accident_Redacted-Rel.pdf https://data.ntsb.gov/Docket/Document/docBLOB?ID=17141169&FileExtension=pdf&FileName=Airframe Maintenance Records - 2018 to Accident_Redacted-Rel.pdf https://data.ntsb.gov/Docket/Document/docBLOB?ID=17141070&FileExtension=pdf&FileName=Propeller Maintenance Records - 2018 to Accident_Redacted-Rel.pdf Although not in the Logs, Dugosh performed the Pre-Buy January 16-23, 2023 This did not appear to be a neglected plane. Maxwell and LASAR are not "bargain basement" providers. A lot of really experienced Mooney mechanics had their eyes and hands on this Encore right up to the time of the accident. How could this 300+ hour engine be in such bad shape?

-

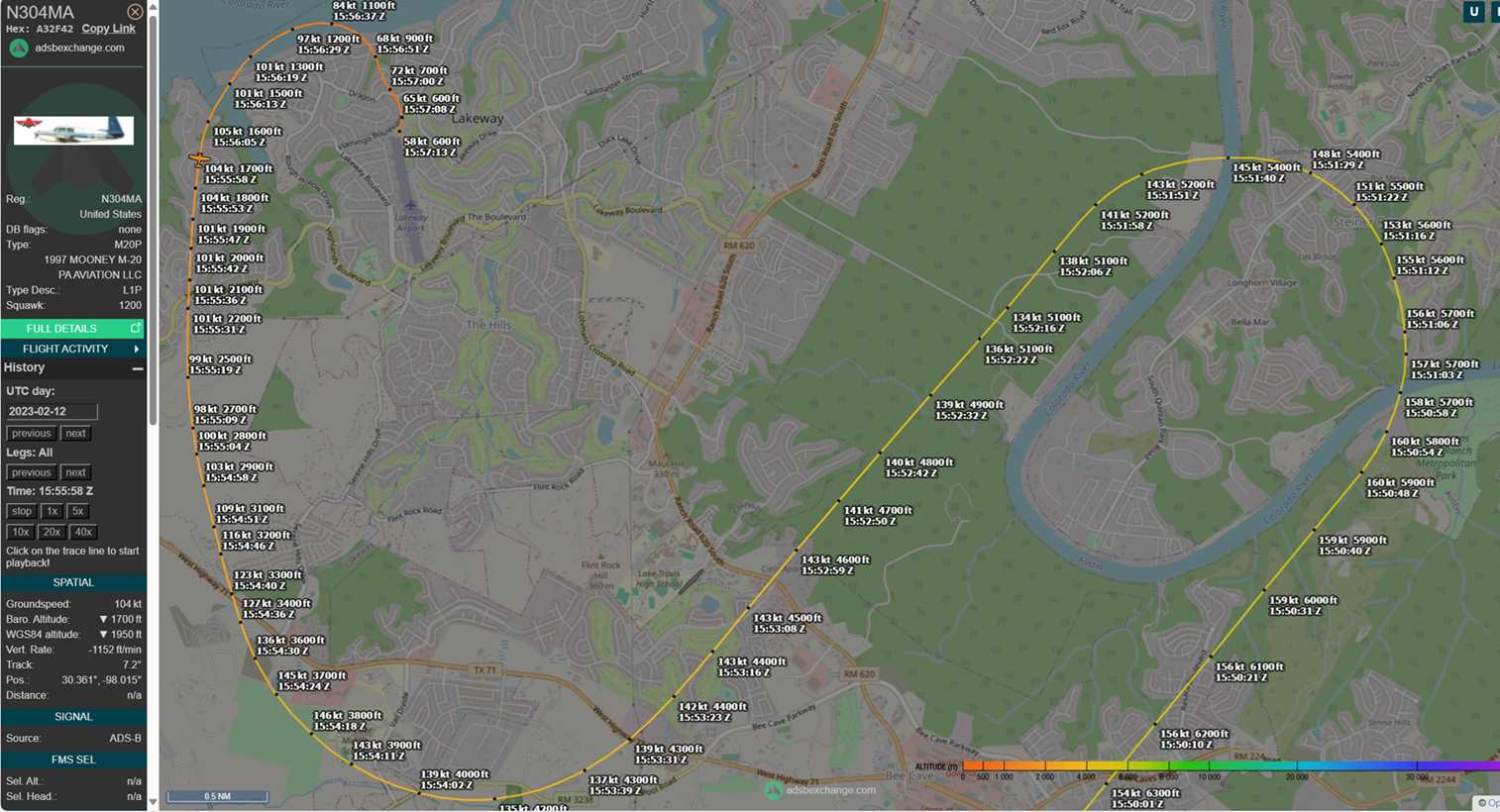

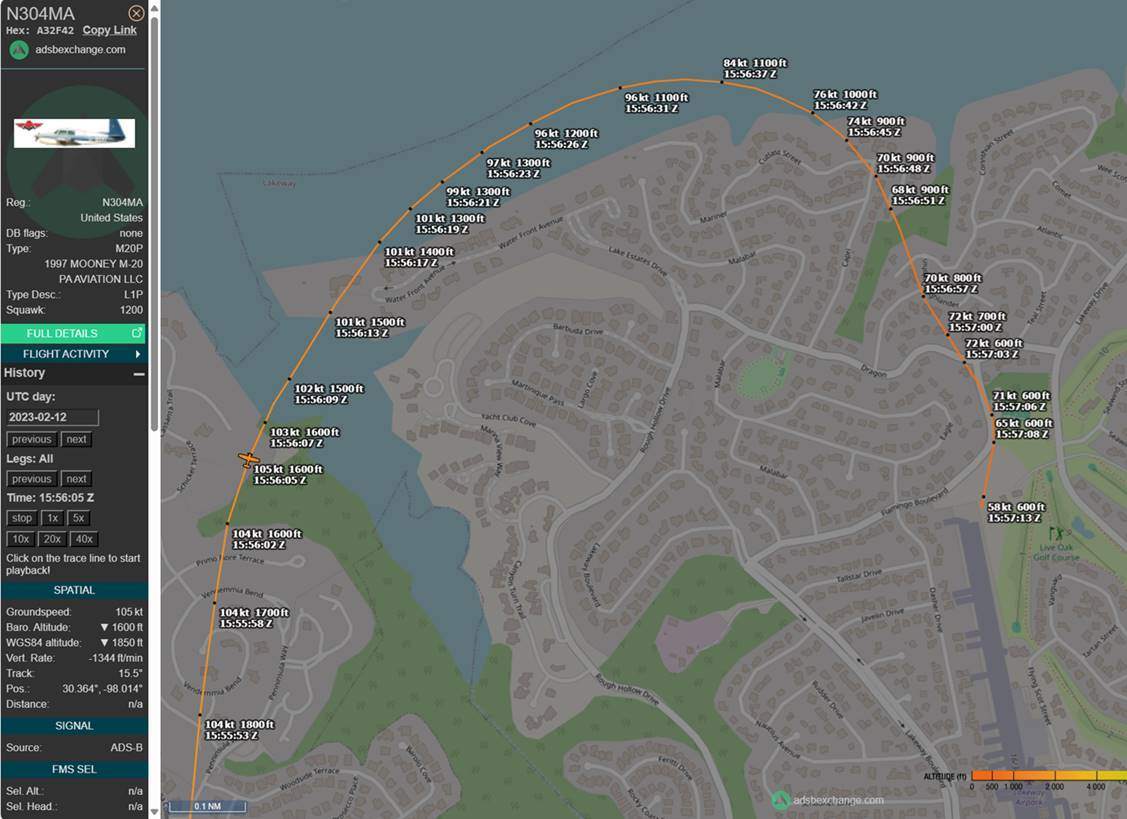

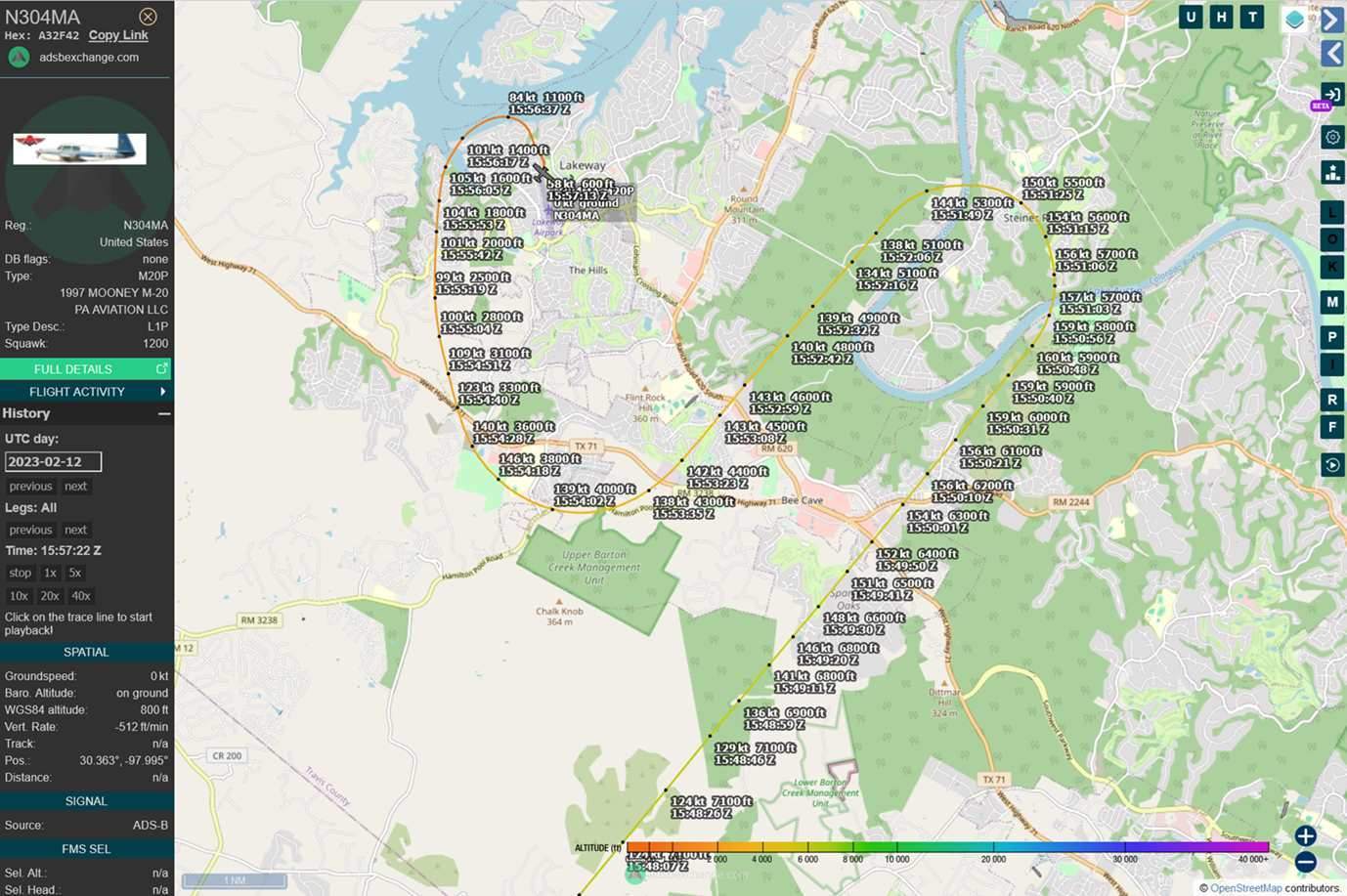

You may be right. Although a 5,400 hour Commercial pilot that is a Helo pilot and a CFI, it is possible that he mismanaged the recip engine to the point that a piston disintegrated. In his statement he said that he did not trust the JPI. See his statement the last 2 pages. https://data.ntsb.gov/Docket/Document/docBLOB?ID=17057139&FileExtension=pdf&FileName=NTSB Form 6120_1_Redacted-Rel.pdf It also unfortunate that he was not able to manage the engine out. I have landed at Lakeway and it is a bit unnerving the first time under the best conditions. This experienced pilot had so much energy - altitude, speed and still partial power within 5 nm of the Lakeway. He turned towards Lakeway and said oil pressure went to zero on downwind but the the engine was still turning until he was on base for short Final. When he was downwind for Runway 16, he said lost oil pressure, About midfield he was at 1,500 ft. AGL and 101 kts descending at -1,155 fpm. Later he was descending at -1,340 fpm and 105 kts while at 1,000 AGL By the time he was turning Base to Final he had lost too much energy and gotten too low and slow. This highlights how difficult and dangerous an engine out is. It is an event that killed Richard McSpadden. This pro pilot survived. We mere amateur weekend pilots may not be so fortunate. https://data.ntsb.gov/Docket/Document/docBLOB?ID=17057139&FileExtension=pdf&FileName=NTSB Form 6120_1_Redacted-Rel.pdf ADS-B Exchange - track aircraft live (adsbexchange.com)

-

ABSBExchange shows that the plane was in Kerrville for nearly a week in late January. Presumably it was at Dugosh doing the Pre-buy. That is plenty of time to address discrepancies. This should have been the best of the best of the best. The pinnacle of Mooney mid-body development managed/inspected by arguably 2 of the most experienced Mooney shops in the world flown by a 5000+ hour Commercial/ Instructor pilot. Instead this pilot came within about 4 feet of killing himself, crushed against the generator station. It’s amazing that the gash in the wing didn’t strike the fuel tank (full for the long relocation flight) and vaporize into an inferno. I think luck played a bigger role than skill that day. And one of the few Encores wound up as scrap metal.

-

Final is out on the crash of the 1997 M20K Encore, N304MA, near Lakeway Airport on February 12, 2023. The engine broke the #6 piston presumably due to detonation. Causes listed are spark plugs worn out of spec, magneto timing out of spec, running lean. The engine had a major Overhaul with new CMI cylinders May 24, 2019 by Jewel Aviation. Don Maxwell Service Center inspected/gapped plugs and checked the magneto timing as part of the Annual on October 8, 2022. Engine 278 hours since TSMOH. (Aircraft hours were 2732) Dugosh did the Pre-Buy Inspection the week of January 17, 2023. Engine hours were 304 (Aircraft hours were 2758) 26 hours after the Maxwell Annual - Dugosh claims that plugs are worn out The accident was on February 13, 2023 Engine hours were 309 (Aircraft hours were 2764 .) 31 hours after the Annual by Maxwell The new owner/pilot (Commercial, Instructor and Helicopter rated) did transition training At about 6,000 AGL and about 5 nm from Lakeway Airport he noticed Fluctuating cylinder temperatures Manifold pressure dropped to 26 in. He could not increase manifold pressure He had partial power and flew towards Lakeway, declaring an emergency While on Final for the runway he lost all oil pressure. He crashed short of the runway So, we are to believe that only 31 hours and about 3 months later after Maxwell had their hands on the engine, the spark plugs wore out and the magneto got so badly out of time that it destroyed the engine? I am having a hard time believing this. The Right Mag was 22 degrees (only 2 degrees advanced over spec) and the Left Mag was 15 degrees (5 degrees retarded below spec). The pilot commented that he had been running lean. Are we to believe that spark plugs will wear out in 25 hours? Are we to believe that Maxwell did not time the mags properly or that they went out of adjustment in 32 hours? If one of the last M20K Encore's made by Mooney, maintained by Maxwell, inspected by Dugosh, flown by a Commercial and Instructor rated Pilot can't reliably make it back to the runway without crashing, what hope is there for 20-40 year older Mooney's in the hands of mere amateur weekend pilots like most of us?..... N304MA | 1997 MOONEY M20K ENCORE on Aircraft.com https://data.ntsb.gov/carol-repgen/api/Aviation/ReportMain/GenerateNewestReport/106726/pdf

-

Another way to look at it is if he had only climbed 2,000 ft and was only 4 statute miles from the runway, then he probably was only in the air 3 minutes. What might cause an engine to stop and appear to be seized in 3 minutes? No oil ?? The safe thing after an Annual or major work is to first preflight exhaustively. (it will be interesting to see if there is airport video of that) Then fly the pattern a couple times. We don't know the experience of the pilot but the Prelim says it was the first time he had flown that particular plane. Generally the safe thing would be to fly the pattern and practice landings a few times. And then - at 2,000 ft AGL an experienced Mooney pilot should be able to glide 11.46:1. The Prelim says he was 1/2 mile short of the runway so he glided only about 18,500 ft or 9.25:1. If experienced and at the top of his game he should have made it. A lot of risks were stacked against the new owner - many that he could have influenced and maybe controlled.

-

Somehow missed this one at the beginning of the year. This was the first flight by a new owner which also the first flight after the Annual was completed. 1979 M20K, N231GG located at Tullahoma Regional Airport (KTHA), Tullahoma, Tennessee on January 3, 2024. During climb-out, at about 2,000 ft AGL and about 4 miles from the airport, the engine lost all power. The pilot turned back to KTHA to glide back to the runway. He attempted to restart the engine but he could not get the engine to turn over with the starter. He landed about a half mile short of the runway in rocky terrain. There are no ADS-B track logs. https://data.ntsb.gov/carol-repgen/api/Aviation/ReportMain/GenerateNewestReport/193598/pdf The plane was sold at a salvage auction last month. 1979 Mooney M20K, N231GG, S/N 25-0171 - McLarens Microsoft Word - Salvage Tender - N231GG (amazonaws.com)

-

Correct. It comes off the back of the engine. This video shows the gears on a 520 that has been pulled but it can be done in place.

-

This was a Rocket Engineering "Rocket 305" conversion of the M20K. The owner's Accident Report and Engine Examination in the Docket shows: Continental TSIO-520-NB17 (s/n 822302-R) (Rocket always put Factory Rebuilt Cont. Engines in the Rocket 305 and Missile 300 unless the owner specified and paid extra for New) The owner stated he owned the plane 22 years and had flown it 2000 hours. He also stated the engine hours were 2000, and that it had been 2000 hours since Overhaul so that means he bought the used K and had Rocket Engineering convert it in 2000. That means the engine had not been overhauled in 2000 hours and 22 years. Continental states that for TSIO-520 below ser. no 1006000, that TBO is 1600 hours and 12 years. Time Between Overhaul (TBO) Periods (captoscana.com) This engine was 400 hours and 10 years over TBO.

-

Yes Swift says "Swift 100R is a 100-Motor-Octane aviation gasoline designed to fully replace 100LL Leaded Avgas across the entire global piston fleet". The key words are "designed to" - that doesn't mean it actually works as "designed" and it certainly has not been proven so. UL94 did not work "as designed" at the UND flight school fleet. Swift Fuels’ 100-octane unleaded aviation fuel granted first STC - AOPA Swift CEO Acosta said to AOPA in the announcement “We’re following a very similar approach where we approve a certain set of engines and airframes and then we expand from that, just like we did nine years ago with UL94,” D’Acosta said. “It’s exactly the same architected program except that’s it’s for the 100-octane fuel." Exactly the same...and that worked out really well for the UND Flight School. Considering that the FAA approval is only for the newest C-172 Skyhawk R's and S's which almost all are found at flight schools, I wonder what flight school will want to risk engine damage for Swift (i.e. UND Ver. 2.0...) I find it really interesting that after the FAA approval, the stories by AOPA, AviaitonWeek, every aviation publication, that if you go to the Swift Fuels website, there is no mention of the approval or the limited STC. There is no mention in the "News" tab/drop down and nothing new on the R100 page. It is almost as if Swift is not proud of the milestone. I bet that Swift thought that they would get a broad sweeping approval - Instead only one engine on one Cessna model News — SwiftFuels

-

That's what happens in a bankruptcy reorganization. The viable parts business is unhitched from all the past liabilities and high overhead costs of the airplane making business. The problem in your analogy is the the viable parts making business will need to also own the IP (engineering data, drawings, specs, certs, etc). The airplane making business becomes a dormant dead company/legal entity that just pays out claims. The trick is convincing a Bankruptcy Court that there are enough assets/cash in the dead airplane making legal entity that can pay out claims. Otherwise the Court will go Chapter 7 Liquidation and just auction everything off in pieces to pay off those that are owed money or have claims. Anyone with a secured claim (like a secured loan, tax authority, maybe a big vendor like Garmin/Cont. etc) stand at the head of the line and get the most - maybe all. That is probably Meijing. The challenge for any "white-knight" or "enthusiastic" investor is that they need to come with two (2) pots of cash. One pot is to buy the stock in the company from US Financial and Meijing. The other pot of cash is to provide start-up/turn around/working capital for Mooney to actually operate. When an investor buys the existing stock of a company, none of the cash goes into the company. It goes into the pockets of the former owners. (That may help you understand why US Financial was perusing a quick flip of the company about a year after they entered - remember the Offering Powerpoint and the lame BizQuest.com advertisement in 2021? https://www.aero-news.net/index.cfm?do=main.textpost&id=37B810E4-8C5F-4A32-9069-F9E524F2E459) If a new buyer does not pay cash for the stock then they may need to write a big IOU. "pay me now - pay me later", It still will cost the buyer. A new buyer would also need a pile of cash to rehire, replenish inventories, come to terms with 3rd party suppliers that are owed money and start up full manufacturing. Suppliers that have been burned will likely demand payment up front with sizeable orders. And then there is the talk of new or improved models - that will take big cash as the failed Chino M10T spending showed. Above there is a comment " near a deal with some investors for a large cash infusion." OK - that's possible. Note that he said "some investors" and not "current investors". That means current investors have no desire or means to put more cash in. So that means yet another party coming to the table with all the other current investors. But if you were the "new" investor, what would you want for your money? US Financial owns 80% and Meijing owns 20%. Do you want some of their stock? - that just puts money in US Financial and Meijing pockets (not into Mooney and does not help fund working capital). Do you want Mooney to issue more new stock that puts cash into the company but dilutes everyone? In either case it would likely be a minority investment without control. Do you want to secure or even buy something like the IP and certificates? - how does that work with everyone standing in front of you? Last money in usually is at the highest risk. Would you make a large cash infusion "no strings attached"? Or would you demand senior rights that wipe out the other investor rights? Just food for thought

-

There is a misunderstanding. Meijing bought 100% of Mooney Corp in 2013. By late 2019 Mooney Corp was shut down and nearly all the employees laid off. A group name "US Financial LLC" acquired 80% of Mooney in 2020. Meijing still has a remaining 20%. Now between 2013 and 2019, Meijing put a lot of money/cash into Mooney. They had an office in California designing the ill fated M10T trainer. In Kerrville they were developing the Ultras and starting manufacturing. They invested at least $100 million. Some say closer to $200 million. When Meijing put money into Mooney they could have done it 2 ways. Mooney Corp could have issued more shares of stock and Meijing could have bought more shares. The other way is for Meijing to loan money to Mooney Corp. Mooney Corp gets the needed cash and Meijing (if they were smart) secured all the IP and assets against the loans. There is no indication that US Financial LLC paid Meijing much if anything. I think Mooney was close to bankruptcy and US Financial convinced Meijing that they could find a buyer and quickly flip the company, making everyone whole and happy. US Financial may own 80% of the stock in Mooney and appear to control. but I bet if Meijing secured everything, then there is little the US Financial can really do other than find a buyer. And since US Financial did not put much in, then if Mooney shuts down completely, they don't lose much. Mooney Corp needs cash badly for Working Capital. It is clear that US Financial LLC is not putting any money in. The post above said the Jonny is " near a deal with some investors for a large cash infusion." That confirms that none of the current shareholders (US Financial or Meijing) either don't want to or have no money/cash to invest in Mooney. https://www.australianflying.com.au/latest/pilots-and-owners-buy-out-mooney-international https://themooneyflyer.com/issues/2020-OctTMF.pdf See Page 3 https://saflyer.com/mooney-changes-ownership/

-

That M20F must have been underinsured and a gear collapse is a much more expensive repair than a clean gear up. The insurance company scrapped it and it was auctioned off last month. Although the owner's sale fell through that day he ultimately "sold" the plane..... 1974 Mooney M20F, N7767M, S/N 22-0023 - McLarens Microsoft Word - Salvage Tender - N7767M (amazonaws.com)

-

Check with @Alan Fox Also BAS has one https://baspartsales.com/550032-011-mooney-m20k-nose-gear-door-assembly-rh-damage-and-dents/

-

And replacement of all the yokes with new parts that don’t exist….Yikes is right.

-

Actually, if Mooney only wanted to be a parts supplier and nothing more with no dream of ever building a plane again, then the best thing would be to file bankruptcy. There would be a "sale of assets" of the engineering drawings, IP, certificates which would go to a new Parts Building Only company. The New Parts Company would right size to less overhead, smaller facility, All the liabilities related to building planes would stay behind in the bankrupt legal entity. All the overhead costs for legal and insurance related to full aircraft manufacturing would be gone. The 3rd party supplier agreements would be gone but the 3rd party suppliers would still need to abide by the Intellectual Property rights that the New Parts Company would own. But everyone overlooks the fact that the Chinese Meijing Group still owns 20% of Mooney Corp. We can say that Meijing was dumb for dumping $100+ millions into Mooney but I doubt that they are stupid. Most likely the money that Meijing put into Mooney is in the form of loans that are secured by the assets of the company including the IP, engineering drawings, certificates, etc. That means that Jonny cannot sell or give away or release any engineering data like on the simple 20 and 40 gears. There is no indication that Jonny and Wyoming LLC US Financial came with bags of money to buy out Meijing or make them whole. Look at what the VanGrunsven family did in the Vans Aircraft bankruptcy. Founder VanGrunsven had been selling his ownership in the company off to the employees (who had no real significant money to put into the company - which sounds like US Financial at Mooney to me). However, VanGrunsven had secured all the assets of Vans with loans to the company in his family name. When Vans filed bankruptcy, VanGrunsven was on both sides of the settlement. It was 'win-win" for VanGrunsven regardless of whether it was a Chapter 7 liquidation or Chapter 11 reorganization. He had every outcome covered. If it went Chapter 7, he could jerk all the designs, engineering, certificates back he was secured. (also all the machine tools). In Chapter 11 (which is the way it went), he is the biggest creditor and wound up with 100% of the stock. VanGrunsven was the "puppet master" in the entire settlement. The employee stockholders got hosed.

-

Why do you believe that the engineering data would be put in the public domain? The company could go inactive or dormant and still hold all their intellectual property. If they have debts which force them into bankruptcy, then there will likely be a Chapter 7 liquidation. The assets will be sold. Someone will likely buy the intellectual property/engineering data assets.

-

You are quoting the total number built over 70 years. The Mooney Company website quotes about 7,000 still in the US and about 1,000 outside the US. That number has been posted for a long time and the fleet shrinks every year. Doing a quick search I find about 6,700 registered in the US.

-

If you search on Google and type "site:mooneyspace.com annual cost", you will get 2-3 pages of MooneySpace topics on Annual Cost and then followed by about another 5 pages of MooneySpace topics on Operating Cost.

-

When you say $5-8 K, is that in Canadian dollars? That is $3.75 - 6 K in the US. 25-27 shop hours is pretty standard for the basic Annual. Shop rates are easily $100/hour - some more. And then you have materials, filters, oil, and something usually needs adjustment or repair. And there may be taxes. If your number is CAD then it seems in range. I forget what you previously flew but retractable gear Mooney increases the Annual about $1K compared to a fixed gear 4-cly Cessna.

-

Here is the Lycoming approved list of fuel by engine. It includes Automotive Fuels by octane (along with Vapor Pressure and maximum oxygenate specs). Unlike the Peterson STC list it approves unleaded Automotive fuel in certain Injected engines including some IO-360 and some IO-540. No turbocharged engines and no IO-390. Service Instruction No. 1070 AB | Lycoming DATE: (lycoming.com)