Texas Mooney

Verified Member-

Posts

62 -

Joined

-

Last visited

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

Texas Mooney's Achievements

-

Sounds like they are just barely making payroll and paying utilities. And are in danger that any unexpected or annual bill will put them under. I wonder if the MSC's have to pay in advance to order parts from Mooney. Then they are the ones directly at cash risk of a Mooney default - in addition to not being able to support the brand.

-

I see comments about visiting the Factory. But nothing about anyone from Mooney giving any update on the current situation or outlook. Maybe I missed it. Were the “unobtanium” parts that only Mooney can get discussed? - the 40:1 Dukes gears topic which new member MathewP was asking the CEO to purchase, the usual No-back spring shortage..

-

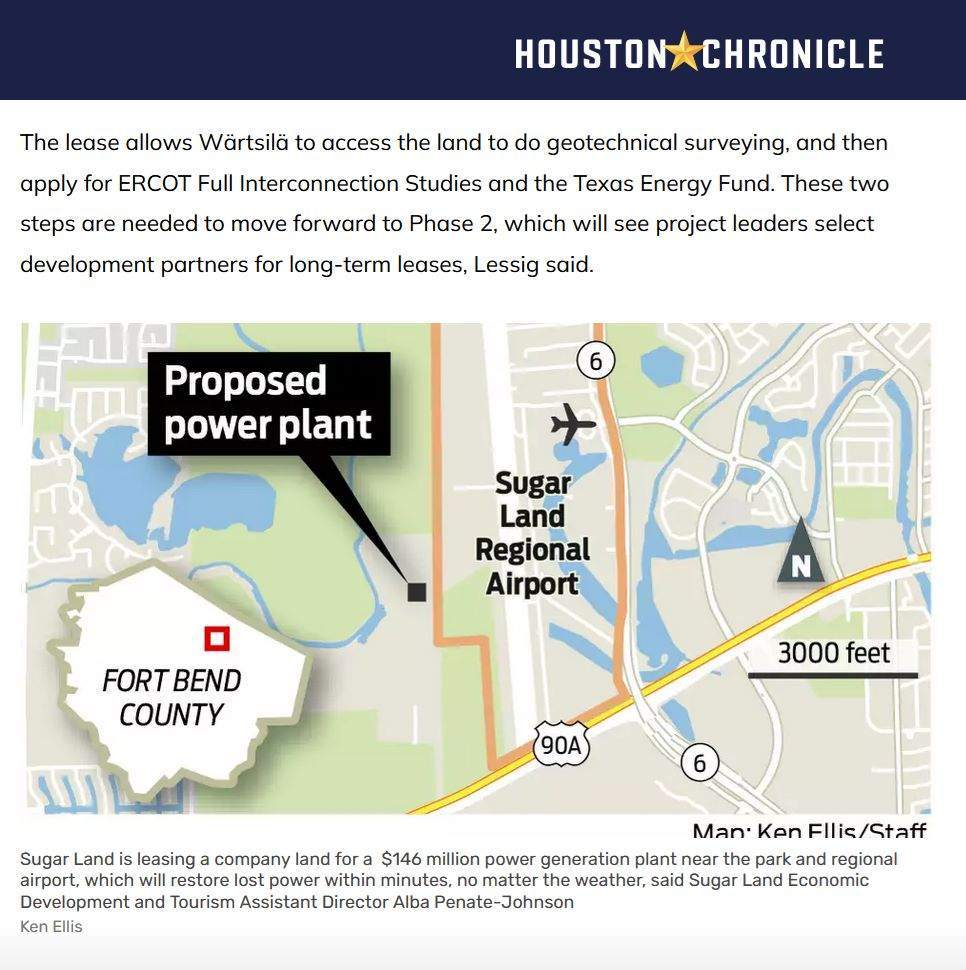

Yup - some of the highest property tax rates in the nation in "(fake) low tax" Texas, That is why the airports in Texas, both public and private, get sold and turned into housing and offices- Robert Mueller in Austin, Weiser, Andrau, and old Westheimer in Houston. The city and county make way, way, way more from property taxes than from hangar rent or fuel sales. The City of Sugar Land talks about developing some of KSGR into " retail, office or hospitality " in their long term plan. https://communityimpact.com/houston/sugar-land-missouri-city/business/2022/04/22/sugar-land-regional-airport-eyes-future-development/ And many may not be aware that the City of Sugar Land has signed a lease to allow a power plant on 9 acres next to KSGR. It used to be a State Prison Farm that paid no taxes....now it will pay $$$$ in taxes. Joy for pilots - lots of power lines and exhaust stacks even if it is "rapid start diesel engine generators". It looks like this: https://www.houstonchronicle.com/neighborhood/fort-bend/article/sugar-land-power-plant-extreme-weather-19474629.php https://communityimpact.com/houston/sugar-land-missouri-city/business/2024/05/31/146m-power-plant-in-sugar-land-aims-to-minimize-impact-of-weather-disasters/

-

Are you Instrument Rated?

-

Everything looked basically normal until he was about halfway down the runway. Then he departed to the left. Unfortunately someone dropped the camera. On Beechtalk there is a lot of discussion about whether the tail wheel (spinning 360) should have been locked. https://imgur.com/gallery/gryder-electra-UVWwTk8

-

Does your insurance policy specifically require a CFI or does it have an “Open Pilot Clause” which allows any pilot with specified sufficient hours in retract gear, type and perhaps Instrument Rating? That might expand the pool for you.

-

What happened to owners maintaining their planes?

Texas Mooney replied to NewMoon's topic in General Mooney Talk

I agree with you. 90 day oil changes is not just dubious, it is ridiculous. Many owners nowadays struggle to fly once a month. I can’t wait for the availability of unleaded Avgas and the introduction of modern long life l aviation oils with corrosion inhibitors. -

If you need/want the OEM 40:1 Gear Set

Texas Mooney replied to Matthew P's topic in Vintage Mooneys (pre-J models)

Then what is your issue with the FAA? I applaud your effort to contact the so far unresponsive Mooney management and beg them to take cold hard cash in advance to place an order with their supplier for a part/product which Mooney controls the intellectual property (design specs). But there is nothing stopping your from making the gear per OPP guidelines and if approved, install it on your plane and report back here. What am I missing? -

If you need/want the OEM 40:1 Gear Set

Texas Mooney replied to Matthew P's topic in Vintage Mooneys (pre-J models)

I am not sure where you are coming from with the comment "and they want to chime in" or "share a viable solution". The FAA has created a viable solution. The FAA will respond to your request for approval (i.e. 'chime in" after you initiate). Go make your part. You may be able to get it approved and put it on your plane. If it fails that is between you and your insurance company (although they may not know that you are exposing them to the liability of an unproven part) The issue is that the FAA is not going to bless OPP made parts that are intended to be sold to others. But if you want to get a PMA and sell gears they will likely approve that. -

If you need/want the OEM 40:1 Gear Set

Texas Mooney replied to Matthew P's topic in Vintage Mooneys (pre-J models)

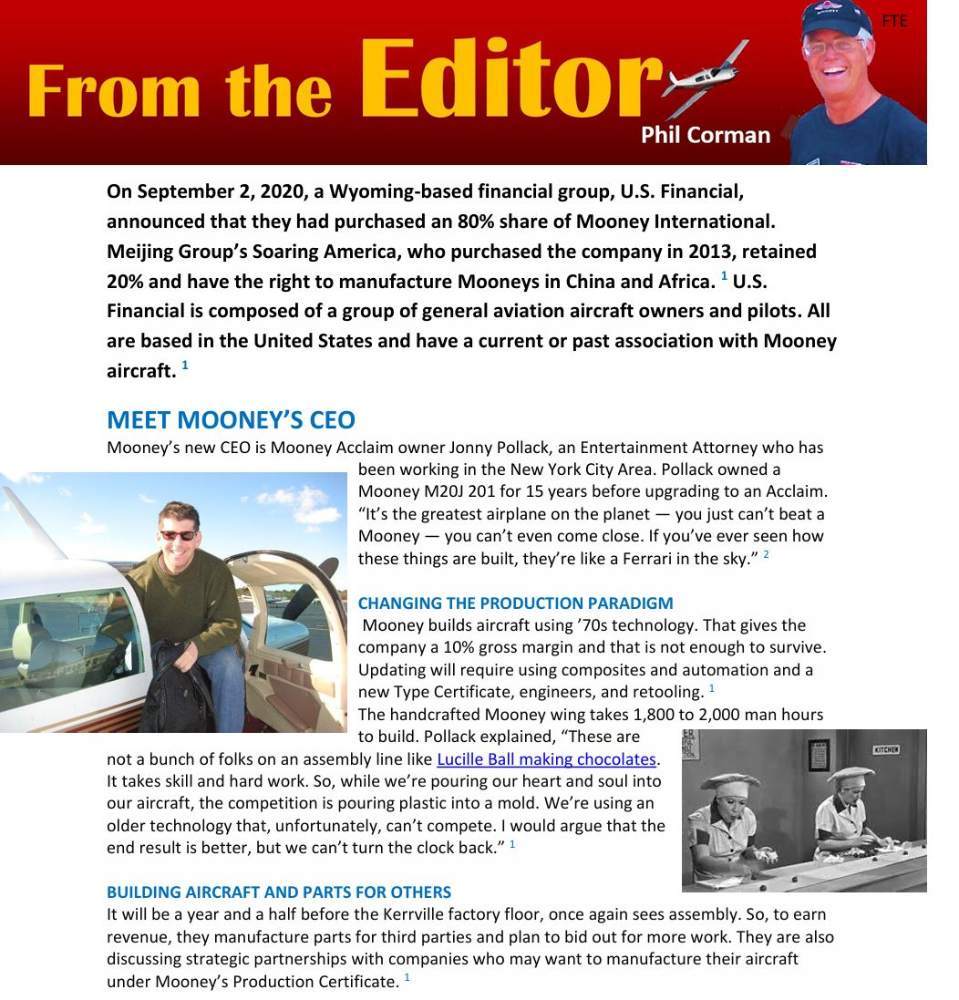

Stop blaming the FAA. The problem is Mooney. In October 2020 the CEO told Mooney Flyer magazine "Supporting the existing fleet remains the new owners’ top priority." Yet in 2024 they have time to manufacture parts for other aircraft companies and to talk about it. Duh. 2020-OctTMF.pdf (themooneyflyer.com) Page 4 -

If you need/want the OEM 40:1 Gear Set

Texas Mooney replied to Matthew P's topic in Vintage Mooneys (pre-J models)

You may have missed the 2020 announcement that Meijing Group sold 80% of Mooney International Corp to a Wyoming based investment group named U.S. Financial LLC. In any event, the legal entities that own the Production Certificates and the TCDS have always been US based even when Soaring America (sub of Meijing) owned the Delaware based Mooney Corp. MOONEY INTERNATIONAL CORP. :: Delaware (US) :: OpenCorporates Mooney International Corp. :: Texas (US) :: OpenCorporates -

He has time to talk to others about how Mooney is making good margins making parts for other aircraft companies.

-

Found this "Investment Reports - provided by Newsweek" article online dated May 28, 2024. It is an interview with Jonny Pollack and seems to be current because Pollack says in the interview that he has been CEO of Mooney for four (4) years without taking a salary. https://www.investmentreports.co/interview/jonny-pollack-1180 Key Points: "We currently enjoy good margins manufacturing parts for several other aircraft companies: our main challenge is scaling up." 35 employees "I believe the future lies in composite technology, which allows for rapid production in molds" "Our plan includes refining existing models to build more efficiently and increase their useful load." Interestingly blames the Trump Administration trade wars for the inability of Soaring America (subsidiary of Meijing Group) to continue funding the business resulting in shut down of aircraft manufacturing. That means that Mooney remained a negative cashflow sinkhole with every Ultra that they built. Content Provider for Interviews Jonny Pollack Jonny Pollack CEO Mooney International 28 May 2024 You are an avid aviation enthusiast and have likened flying a Mooney aircraft to flying a Ferrari in the sky. What exactly makes the Mooney aircraft so unique? Mooney aircraft stand out due to their engineering excellence. Each Mooney is handcrafted, ensuring meticulous attention to detail and quality. In general aviation, trainer aircrafts use cables and pulleys, which delays response time, whereas we use pushrods, allowing immediate feedback to any control input. It's also extremely fast, holding general aviation speed records at 240 knots true airspeed at 25,000 feet in ideal conditions - the closest competitor is 8 or 9 knots slower. We use a turbocharged Continental IO550 engine and a laminar flow wing featuring a sturdy aluminium spar extending from tip to tip, which enhances its efficiency and safety. This design has been a staple in Mooney aircraft for over 70 years. You joined Mooney as CEO in 2020 following a turbulent few decades consisting of financial troubles and multiple changes of ownership. Why did you join what many people considered a company on the brink of collapse? I joined Mooney partly due to a personal connection to the brand and partly due to a vested interest given that I had previously purchased my own Mooney aircraft. For context, the previous owners - investment firm Soaring America - were impacted by trade wars under the Trump administration, could no longer fund operations, and had to cease production. Initially, I evaluated the company’s status and prospects, but driven by a sense of responsibility to our clients and the broader community relying on our aircraft, I ended up accepting the CEO position without a salary for four years. Mooney faces operational challenges, mainly supply chain issues that affect our parts availability. It’s my responsibility to stabilize our financials and preserve the company sufficiently so that eventually, new leadership can turn things around and Mooney can return to manufacturing aircraft in full. I consider my tenure as managing the company through crisis effectively, aiming to set a foundation for future success so we can transition away from being a parts manufacturer to resuming full aircraft manufacturing under the Mooney brand. As you focus on building a more solid foundation for Mooney, what economic uncertainties are keeping you awake at night? The aviation business presents challenges in building aircraft efficiently. The complexity arises from managing thousands of parts and adhering to stringent Part 23 certifications. Such certifications demand a rigorous quality control system where every component must meet precise standards. This requirement not only enhances safety but also significantly raises costs. Moreover, the dependency on a reliable supply chain has been a critical issue, especially post-Covid. The necessity for a robust infrastructure of engineers and quality assurance teams to comply with FAA regulations adds another layer of complexity. These factors combine to make aircraft manufacturing costly, with the net margin severely impacted by substantial overhead costs associated with maintaining the necessary quality controls. Tell us about Mooney’s portfolio and geographical spread of customers across the US and the world? We operate 7,000 aircraft worldwide, exclusively manufactured in the United States. Many are certified for international flights, such as in Australia and South Africa. We don't sell aircraft outside the U.S., yet interest has risen in our all-metal aircraft due to global warming concerns and structural integrity in extreme heat. Mooney aircraft, primarily aluminum, are known for efficiency and reduced fossil fuel consumption. In the U.S., our main clients are individual pilots. While our competitors focus on family-oriented marketing with safety features such as parachutes, our planes have a slightly lower useful load like the SR-22. Due to our aircraft’s payload limitations and narrower cockpits, we cater to that specific demographic. You have mentioned that Mooney operates like a startup but also uses 1970s technology. How do you plan to modernize the design and accelerate automation to keep Mooney competitive in 2024? We will be modernizing both our manufacturing methods and the products themselves. Currently, we produce metal aircraft using traditional methods such as stamping and forming but I believe the future lies in composite technology, which allows for rapid production in molds—however, this method involves significant certification costs and time. All planes fundamentally use technology developed from the early days of aviation, with recent changes focusing on propulsion methods like VTOL and hybrid engines. Our plan includes refining existing models to build more efficiently and increase their useful load. Do you have a projected timeline for when Mooney might become revenue-neutral or cash-positive and begin a transition? We currently enjoy good margins manufacturing parts for several other aircraft companies; our main challenge is scaling up. Unlike Cessna, which services thousands of trainers, our fleet consists of only 7,000 aircraft. Once we have acquired the necessary capital, I anticipate we could be revenue-neutral within a year. At that point, I'd likely step aside to let new leadership drive further growth. Given the intense competition, why have you opted to keep Mooney in Texas and not outsource for cheaper manufacturing labor? Mooney's identity is deeply ingrained in Texas; it's part of our legacy. Our commitment remains strong due to significant incentives to retain manufacturing operations locally. Although our team size is smaller than ideal—35 instead of 235—our team embodies the spirit and dedication Mooney stands for. Licensing production overseas would involve complex and costly certification processes in those countries. We prefer to build kits in Texas and ship them abroad for assembly under strict regulations, maintaining our quality standards and supporting our local community. JoeBen Bevirt Joby Aviation 28 May 2024 Thomas Olivier Omnos 28 May 2024 71-75 Shelton Street, Covent Garden, London WC2H 9JQ, UK info@investmentreports.co +40 740 631 208 Investment Reports © 2024 All rights Reserved

-

The account he used in the past still exists, but he has not signed in under that name since December 2022. His last post was July 2022. Has he become a Zombie CEO or is he lurking around incognito under another name?...

-

Did he in fact sell his Acclaim (N705SE) or did he just transfer it to an LLC? N705SE is now registered to TXNY LLC which suspiciously sounds like someone that lives in NY that travels to TX.....