-

Posts

4,104 -

Joined

-

Last visited

-

Days Won

28

GeeBee last won the day on November 27 2025

GeeBee had the most liked content!

Profile Information

-

Reg #

N192JK

-

Model

M20R Ovation 2GX

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

GeeBee's Achievements

-

Dallas to Los Angeles - Long Way Round

GeeBee replied to Max Clark's topic in Miscellaneous Aviation Talk

Yes you need to do both Mt. Rushmore and Custer State Park. -

Two different places. 75 meters was at AMS. Both have ground fog as a common occurrence.

-

Equally so, you never know when you are "tricked" into visual acquisition with ground fog. I've been in situations where the reported RVR was 75 meters, yet I had the runway in sight from 5 miles out and all the way to main gear touch down, it did not become 75 meters until the nose gear touched down. I've seen a similar situation in the CA Central Valley with its famous "valley fog" which is really ground fog. One time at KSCK visibility RVR 2400. Executing a CAT I approach, I had the runway fully in sight, HIRL, ALS, even stars above me. At 100' I was in 1/2 mile fog. I still had the runway in sight but staying on the GP guided me to a smooth and stabilized touch down. Stay on the GP until it is no more.

-

This is true of all simulators. Even the most sophisticated (and I have flown in the very best) are harder to fly than the real airplane for a variety of reasons including inertia and stability. That said, the degree of difficulty in the simulator makes you a much better pilot in the real airplane. There are some other things that will force you to be better. For instance I get "simulator eyes" from 200' down in the sim. My depth perception goes to heck. For that reason, I never look outside until 50' so I can pretty much hand fly a CAT IIIA raw data on course and slope looking up at the last seconds to flare. That ability to fly the slope down low serves me in the real world when I go to the bottom of the barrel on a CAT I at night. Many pilots upon identifying the runway environment at 200' have a "duck under" tendency. My sim training aids in not letting that happen.

-

Bingo!

-

Weather does not always cooperate enough to meet 61.57 (c) (1) to make an approach, hold or interception legal. In the South if you have weather conditions less than VFR during the summer, you probably don't want to be in them.

-

But the objective of a BATD is for instrument currency and competency. You don't need Level D for that. The overhaul cost all in for an Ovation is about 75K. So if you spend 10% of that time droning around for instrument competency, you've covered the cost of a BATD right there. The other day I had a bad electric fuel pump, 2500 installed. We have not even talked about fuel, tires etc, nor the extra strain on the engine of training events. Even if it is break even, the efficiency of a simulator cannot be overcome. I can do 3 approaches in 22 minutes. At that rate I have 300% more practice than someone in a real airplane.

-

My view on spending 10 grand is this. I think like the airlines. My airplane is for going places, not droning around on approaches and holding patterns to satisfy the FAA. The current cost of an Ovation overhaul plus the fuel, plus wear and tear on ancillary items easily amortizes that 10 grand. Any money spent on a device that does not satisfy the FAA requirements is not valueless procedurally, but it will not do any thing to defray the costs and wear and tear on your airplane. I'll add there is the additional value of not droning around putting yourself into position for an approach or other maneuver. You can snap right to the position making more efficient use of the training time.

-

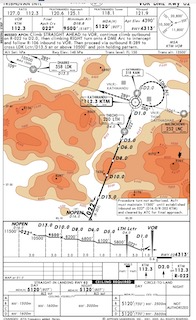

I purchased a Redbird TD2, the full monte. 3 screens, the desk and rudder pedals. I like that it simulates fairly good my G1000 system. What they don't tell you is you need to buy a 400 dollar nav data base. It is a world wide data base and I don't update it but every other year which is good enough. I have had one issue with the set screw on the yoke working loose, but I repaired it easily. Other than that it works really good. It has sufficient fidelity that when I set up an approach to Lake Tahoe, I could not maintain altitude (13,000) until I properly leaned the engine. I am very used to simulator instruction and operation and that helps get the most out of the unit. If you're not used to it, you need to be disciplined in your approach and use. Treat every flight like it is the real thing and be honest with yourself in your self de-brief. I like that I can log it for currency and I often find myself shooting approaches to an airport I have not been into. Overall, I would highly recommend a BATD if your objective is serious instrument currency. I cannot speak to the Gleim but I feel the Redbird is good value. If you don't want to be able to log approaches and time, get the toy units. Once you own one of these things you'll find hand flying approaches in the real world very easy because you're proficient beyond most pilots. One thing that might change in the future is the use of VR goggles which I think will make a huge change in vision simulation.. I am fairly sure you'll see that as the next big thing although FAA approved as BATD? Who knows. By the way, if you want a work out on step down approaches, fly the VOR into Kathmandu, Nepal. You will get very good at it.

-

Either antenna or GPS outage.

-

Know Your Circuit Breakers

GeeBee replied to Max Clark's topic in Mooney Safety & Accident Discussion

Then there are those really crappy CBs that are flush and cannot be pulled like Cessna used for so many years -

Years ago I was D of Ops for a flight school and charter operation in San Jose. We had a SJPD officer who was a student. One evening he went behind the counter and removed keys to a Beech Duchess from the key vault. He was intoxicated and before law enforcement could arrive he was taxing out in the Duchess. A county sheriff blocked him at the runway bars, but he flashed his badge and the deputy stupidly backed off and he took off without takeoff clearance. The dispatcher called me at home. I jumped in my car to go to the airport and I rolled a stop sign and was pulled over by the SJPD. I said, "This is great, you pull me over on my way to the airport to deal with one of your drunk officers who stole my airplane." They said, "We just heard it over the radio, you're released, just be careful". So I arrived at the airport, called Tracon got a fix told them I would be airborne in an Aerostar in a few minutes. I got airborne, talked to Tracon, got another fix over the Altamont pass. I figured he was heading to the Central Valley. So I shoved the power up, went over the mountains to the SE to cut him off. Tracon lost him, but OAK Center had him. I caught up with him over Tracy. I was screaming and I closed on him fast. I pulled up on his starboard side being careful of any ramming idea he might have. I motioned for him to follow me. I guess he figured his goose was cooked and we started a turn towards home. I called RHV tower, declared an emergency and asked for equipment to standby in case he crashed. He approached 31R and landed with me beside, at 100' I went around and returned for landing. I followed him to the ramp where he was shut down. I was really PO'd, in a bad mood and the SJPD took him into custody. The Sergeant said he was not going to cuff him. I said, "Like H.....you're going to cuff, transport and book him and I'm calling my sister in the DA's office to make sure you do exactly that." Anyway, he pled out guilty, lost his job, kept his pension, received probation. To the OP, it happens often.

-

It's personal. I was at FXE the other day at the Banyan pilot shop and a store employee was instructing a new hire and she said, "The choice of a headset is highly personal, we have this display so they can try them all." That is what I recommend. Go to a shop that has them all, try them all on, try listening through them and decide what you like. Me I am happy with my Bose A20, don't see the need to upgrade to the A30. Agree about BT. Must have. I operate out of an uncontrolled field so the ability to phone for clearance and to cancel IFR is important to me. The best headset I ever had was experimental made by Terma, a Danish defense contractor. It had two custom molded earpieces with the mic pickup built in to the earpiece. It used the jawbone as a sound reflector. It was amazingly clear, no boom hanging around. The earpieces acted as passive noise reduction. Unfortunately they could never pass the FAA TSO requirements so they gave up and recalled them all. I wish someone would pick up the design.

-

If that were true we would see rates for older pilots change little for 172, 182 and the like, but we know they do, dramatically.